How Is The Federal $300 Unemployment Bump Affecting Local Michigan Businesses?

Just last week I wrote a piece asking “Is It Time For Michigan To Reject The Extra $300 In Federal Unemployment Bump?”. The reason I asked that question was the concerns I was hearing not only nationally but right here in Michigan from employers who are unable to find people to fill their open positions.

There are currently four states that have decided to stop accepting federal unemployment benefits because many if not most of their employers are struggling to find people to fill their open positions. Those states are Iowa, Montana, North Dakota and South Carolina.

This week I still am asking the question; Is it time for the state of Michigan to join them?

A Michigan business group believes it is. That group is the Michigan chapter of the National Federation of Independent Business (NFIB). MLive reported that the Michigan director of the NFIB, Charles Owens said:

“There are just too many jobs and too many people who are not incentivized to take them”

The fact that there are too many jobs and due to the per week federal bump of $300 people appear to not be incentivized to take those jobs. That is exactly why the four above-mentioned states have decided to decline the extra $300 a week federal cash.

The NFIB surveyed 10,000 business owners nationwide and discovered that “44% of small business owners report having job openings they can’t fill”. The question now is how many small business owners in Michigan are having trouble filling their open positions.

Currently, the most Michigan will pay an unemployed person is $362 a week. When you add the extra $300 a week from the Federal government you are collecting $662 per week. That is equal to $16.55 per hour, for a 40 hour week, to not work. That is not including the fact that you do not have to pay payroll taxes or federal income on those unemployment benefits.

U.S. News and World Report reported:

Millions of people received unemployment benefits in 2020, and many are in tax limbo now. The federal government usually taxes unemployment benefits as ordinary income (like wages), although you don't have to pay Social Security and Medicare taxes on this income. But the American Rescue Plan Act of 2021, the stimulus bill that was signed into law on March 11, 2021, changed the rules.

People whose adjusted gross income was less than $150,000 can exclude up to $10,200 of unemployment benefits from taxes in 2020. If two spouses both received unemployment benefits, they can each exclude $10,200 from their income as long as they are under the $150,000 adjusted gross income cutoff on their joint return, says Mark Luscombe, principal federal tax analyst at Wolters Kluwer Tax & Accounting. "The $150,000 is a cliff, not a phaseout, and is the same for all tax returns, whether single filers or joint filers," he says.

When you consider that you do not have to pay payroll or federal income taxes that hourly figure could be $19 dollars or more an hour.

That extra $300 a week will last until September of this year. Can anyone really argue that is not a huge incentive not to work?

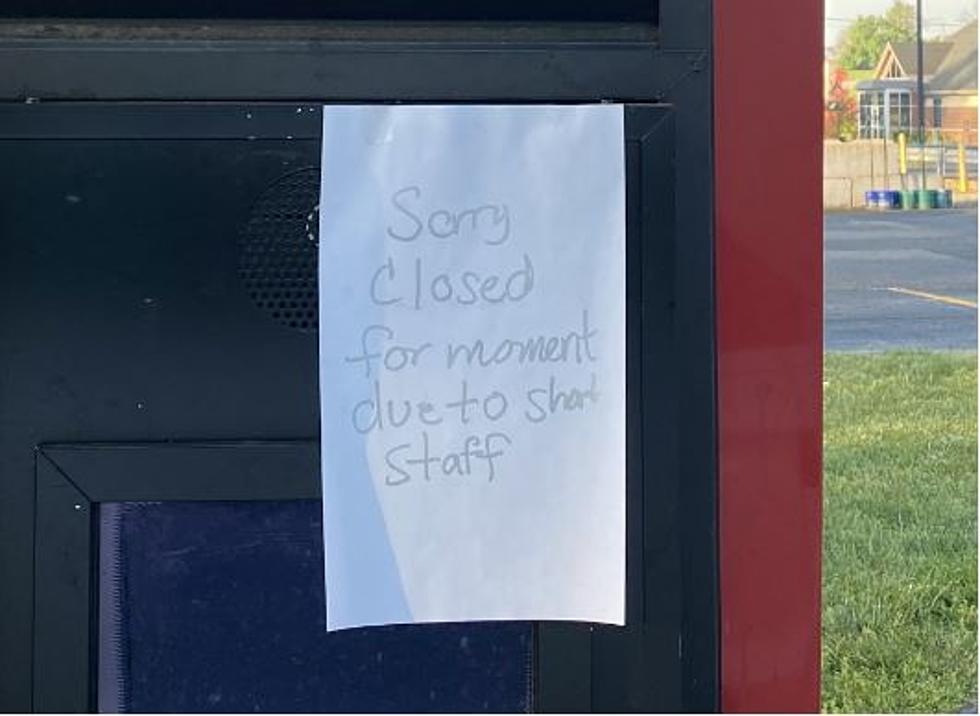

I can now bring you an example of this exact problem right here in southwest Michigan. I was sent the picture below from a listener who went to a fast-food restaurant to purchase breakfast yesterday morning and when they drove up to order from the drive-in window they found the following sign:

This is exactly the problem described by many employers across the state and country and why we need to seriously consider no longer accepting this $300 bump from the federal government. These restaurants and other businesses who were first hurt by the virus are now being hurt by their own government.

We are told that they just cannot find people to fill their open positions, thus there are times that they are unable to open or must close. That not only hurts the business but also employees who want to work and actually earn a living but are unable.

More From WKMI